You have the flexibility to pay off a 30-year mortgage in 15 years, if you want. Here's what it would cost you.

By MSN Money partner Jun 29, 2012 10:21AM

When it comes to the great mortgage debate, The 30-year loan is better for a multitude of reasons. In fact, I think it's a no-brainer.

When I bought my first home in 1990, interest rates were in

double-digit territory. Today, 30-year loans make more sense than ever

with mortgage interest rates

continuing to set new all-time lows. In fact, last week, a person with

excellent credit could get a 30-year loan for rates as low as 3.375% and

15-year loans for an incredible 2.75%.

So why is the 30-year mortgage a better choice? One of the biggest advantages is its flexibility. After all, holders of 30-year loans can always make the extra payments required to pay them off in 15 years, should they choose to do so.

However, the poor guy with a 15-year note who suddenly gets laid off or runs into other unexpected financial difficulties can't reduce his payments in order to stretch that 15-year mortgage into a 30-year loan. Sure, he could try to refinance, but that can be difficult -- especially for the unemployed.

Of course, the trade-off for having additional flexibility is higher interest payments.

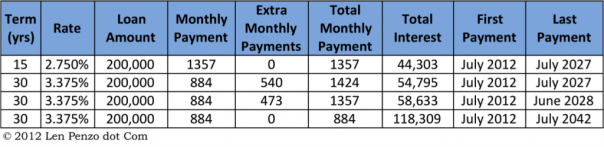

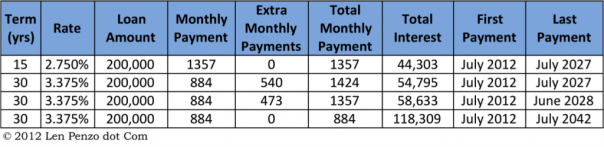

Assuming a $200,000 loan, the impacts of those higher interest payments over time at today's rates can be seen in the following chart:

Obviously, folks with a 30-year mortgage are going to pay more interest, whether or not they make the extra payments required to retire their loan in roughly 15 years. Then again, how much more depends on how picky they are about getting the loan paid off in exactly 15 years.

In my example, a 30-year $200,000 mortgage at 3.375% results in a monthly payment of $884. Over 30 years, the homeowner would end up paying $118,309 in interest to the lender -- $74,000 more than a homeowner with a 15-year loan at 2.750%.

However, those who are truly serious about minimizing their interest costs by paying off that same 30-year loan in exactly 15 years could do so by increasing their monthly payments to $1,424 -- $540 more than the minimum payment.

Over the life of the loan, that strategy would result in interest expenditures of only $10,491 more than the 15-year mortgage. Spread out over 15 years, it's a premium of just $58 per month. Not bad at all for those looking for the added peace of mind.

Alternatively, faithfully making monthly payments over the life of the loan equal to that required by a 15-year mortgage at 2.75% ($1,357) would result in slightly higher additional interest costs of $14,330. That's a premium of $74 per month over the life of the loan, which would be a bit longer -- 15 years, 11 months.

So there you have it. Hopefully, this little example provides you with a bit more insight into just how much extra it currently costs to take on a 30-year loan over its 15-year cousin.

As you can see, no matter how you slice it, people who prefer the numerous advantages of a 30-year loan over a 15-year mortgage are always going to pay more interest. But for those who are looking for the extra flexibility of a 30-year loan as a hedge against a sudden loss of income, the added premium is a relative bargain.

So why is the 30-year mortgage a better choice? One of the biggest advantages is its flexibility. After all, holders of 30-year loans can always make the extra payments required to pay them off in 15 years, should they choose to do so.

However, the poor guy with a 15-year note who suddenly gets laid off or runs into other unexpected financial difficulties can't reduce his payments in order to stretch that 15-year mortgage into a 30-year loan. Sure, he could try to refinance, but that can be difficult -- especially for the unemployed.

Of course, the trade-off for having additional flexibility is higher interest payments.

Assuming a $200,000 loan, the impacts of those higher interest payments over time at today's rates can be seen in the following chart:

Obviously, folks with a 30-year mortgage are going to pay more interest, whether or not they make the extra payments required to retire their loan in roughly 15 years. Then again, how much more depends on how picky they are about getting the loan paid off in exactly 15 years.

In my example, a 30-year $200,000 mortgage at 3.375% results in a monthly payment of $884. Over 30 years, the homeowner would end up paying $118,309 in interest to the lender -- $74,000 more than a homeowner with a 15-year loan at 2.750%.

However, those who are truly serious about minimizing their interest costs by paying off that same 30-year loan in exactly 15 years could do so by increasing their monthly payments to $1,424 -- $540 more than the minimum payment.

Over the life of the loan, that strategy would result in interest expenditures of only $10,491 more than the 15-year mortgage. Spread out over 15 years, it's a premium of just $58 per month. Not bad at all for those looking for the added peace of mind.

Alternatively, faithfully making monthly payments over the life of the loan equal to that required by a 15-year mortgage at 2.75% ($1,357) would result in slightly higher additional interest costs of $14,330. That's a premium of $74 per month over the life of the loan, which would be a bit longer -- 15 years, 11 months.

So there you have it. Hopefully, this little example provides you with a bit more insight into just how much extra it currently costs to take on a 30-year loan over its 15-year cousin.

As you can see, no matter how you slice it, people who prefer the numerous advantages of a 30-year loan over a 15-year mortgage are always going to pay more interest. But for those who are looking for the extra flexibility of a 30-year loan as a hedge against a sudden loss of income, the added premium is a relative bargain.

No comments:

Post a Comment

Please Leave a Comment, I welcome feedback and the opportunity to hear of your personal experiences with myself or other realtors...